This is part 4 of a seven part series which explores some of the issues around zero carbon vehicles and which future technologies might be best for HGVs to avoid carbon emissions. The seven parts are:

- Understanding the Typical Power Requirements of an HGV

- Basic Designs of Diesel, Battery and Fuel Cell Powertrains

- Comparing Diesel, Battery and Fuel Cell Powertrains

- Assessing Future Manufacturing Costs of Diesel, Battery and Fuel Cell Powertrains for HGVs (this post)

- Costs of Hydrogen Fuel / Building A Hydrogen & Electric Charging Infrastructure

- Commercial Viability of Operating A Battery or Fuel Cell Powertrain HGV

- Summary, A Look at Developments Which May Help Achievement of Zero Carbon In-use HGVs.

Part 4: Assessing Likely Future Manufacturing Costs of Diesel, Battery and Fuel Cell Powertrains for HGVs

Part 4 looks at likely capital and operating costs of diesel, electric battery and hydrogen fuel cell Heavy Goods Vehicles (HGVs). Estimating costs can be challenge when comparing a well established technology such as a diesel powered HGV with millions of units sold each year (TRL9, or Technology Readiness Level 9 as defined by the US Department of Energy) with technology which is at engineering prototype (TRL6) or demonstration system (TRL7). In particular:

- Cost reductions on battery and fuel cell components are heavily dependent on production volumes.

- The capital costs of building recharging stations or hydrogen refuelling stations will depend on how many are built, whilst the operating costs will be dependent on how much the are used.

- Fuel tax policies vary, with UK fuel duty and VAT applied to petrol and diesel. The approach of government to losses of revenue as fossil fuel powered vehicles decline will influence the speed of uptake.

4.1 Storage Battery Pack Manufacturing Costs

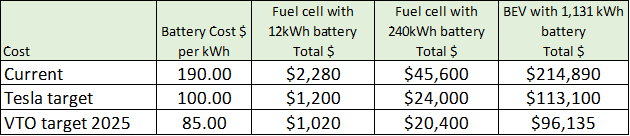

Figure 14 shows the current battery pack costs per kWh along with Tesla’s target and the VTO goal (Vehicle Technologies Office, US Dept of Energy). These costs are then used to calculate the total costs of pack sizes for different HGV vehicle design options. These are manufacturing costs so manufacturer and dealer profit margins would have to be applied to these to calculate what a truck operator would pay.

The typical purchase price of a diesel HGV is circa $141,000. By the time even the most ambitious cost target for 1,131 kWh of battery storage is achieved (potentially around 2025),and applying a 100% mark up of costs to cover manufacturer and dealer margins then 1,131kWh of battery storage is going to add circa $192,000 to the purchase price. Whilst there are some savings to be made, such as the cost of the diesel drivetrain, they are of a smaller scale.

4.2 Electric Traction Drive System Costs

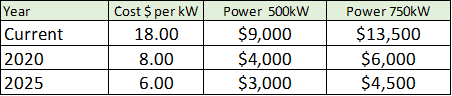

Figure 15 shows that electric traction drive system costs (combination of electric motor and power electronics) are likely to fall. Two drive systems are shown, one with either 500kW or 750kW drive. USDRIVE (2017a), which is primarily focused on car rather than truck technology, has identified that electric traction drive systems (combination of electric motor and power electronics) are currently costing $18/kW with targets of $8/kW (2020) and $6/kW (2025).

These targets do not include any allowance for other possible technologies such as recovering residual braking energy or for systems such as the Bosch eAxle, proposed for use in the Nikola One, which also include transmission and gearing. The eAxle is available in power outputs from 50-300 kW (Reuters 2017, Bosch 2017, 2018).

4.3 Hydrogen Storage Tank Costs

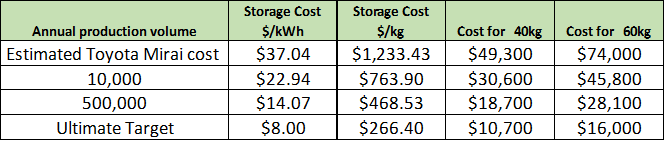

Table 16 shows indicative 700 bar hydrogen storage costs for 40kg and 60kg storage based on estimated current Toyota Mirai costs and estimates on larger volumes of current designs as well as the ultimate target (DOE 2015b, SA 2016b & 2017). Even at relatively high volumes the hydrogen storage tank is a significant cost, underlining the emphasis on fuel tank strength to ensure that 700 bar hydrogen is stored safely.

4.4 HGV Fuel Cell System Costs

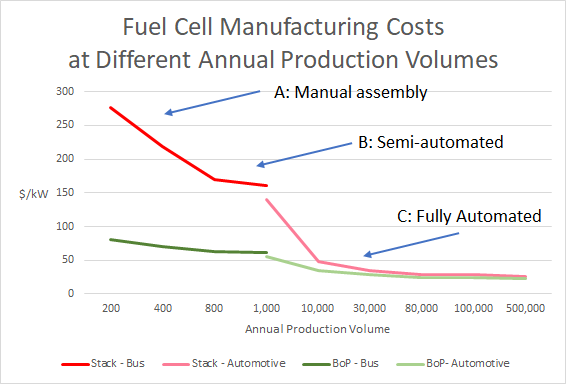

With the lack of commercial data on costs of truck fuel cell systems (stacks plus BoP), assessments on cars and buses produced by Strategic Analysis (SA 2016a) for the US Department of Energy have been used to generate indicate costs for trucks.

Note that the SA assessment differentiates between gross power (fuel cell total output) and net power output (power available for wider use outside of the fuel cell system) the difference being the power required by the Balance of Plant (BoP). All reported figures in this article are gross unless otherwise stated. SA have chosen to produce separate Bill of Material’s for cars and buses, based on different stack sizes and for volumes of 200-1,000 units for buses and 1,000-500,000 for cars. Figure 17 shows SA’s estimates for both fuel cell stack and BoP costs per kW for buses and cars and has been annotated to indicate the move from manual to fully automated assembly and production.

This article contends that given the modular approach articulated by Toyota, it is reasonable to merge the cost curves for buses and trucks, whilst recognising that the “per kW” costs for a bus or truck are likely to be slightly higher, to reflect higher material specifications to deliver higher total lifetime mileage expectations (500,000 miles). SA show cost difference where car/truck volumes overlap (at 1,000 units per year) of 15% for stacks and 10% for BoP and these percentage differences have been maintained for projecting costs for bus volumes beyond 1,000 units/year. Bus costs are based on 350 bar hydrogen storage pressure; costs may be slightly higher for 700 bar hydrogen pressure although this has not been quantified.

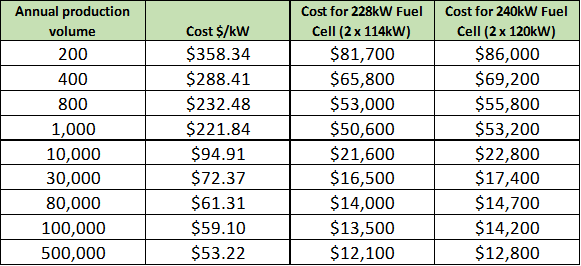

The result of this extrapolation, together with the absolute fuel cell cost for systems is presented in Figure 18. This assumes fuel cell outputs of 228kW and 240kW. The 228kW output is based on using two 114kW fuel cell stacks from the Toyota Mirai hydrogen fuel cell car whereas the 240kW output is based on two 120kW stacks which Nikola* are potentially using for a demonstrator fuel cell HGV they have been working on. * The manufacturer’s specification may change

Figure 18 shows there is potential for significant cost benefits for fuel cell system manufacturers who can achieve vehicle sales using upwards of 10,000 fuel cell systems. Currently this would include:

- Toyota, whose strategy is to sell 30,000 units annually after 2020 across a range of vehicles (Reuters 2018). SA’s cost analysis calculates the Mirai fuel cell system manufacturing cost as $142/kW for 3,000 units/year using mainly manual assembly.

- Nikola who plan to sell 50,000 trucks annually using PowerCell and another unidentified fuel cell stack supplier using 2 x 120kW stacks. No timescale is given although a Frost & Sullivan analyst predicted 2,300 to 4,800 units by 2025. The upper volume prediction would, with two fuel cell stacks per truck, take Nikola close to the 10k level, although there is no clarity on when/whether the stack suppliers would pass cost savings on (PowerCell 2017, Trucks 2016).

The SA assessment also presents example pathways to achieve US Department of Energy 2020 targets (FCTO 2016) of $40/kW and an ultimate target of $30/kW based on 500,000 units per year. SA’s analysis suggests that the use of potentially scarce/costly materials such as Platinum can be reduced from existing levels as a result of technical advances.

4.5 Overall Powertrain Cost

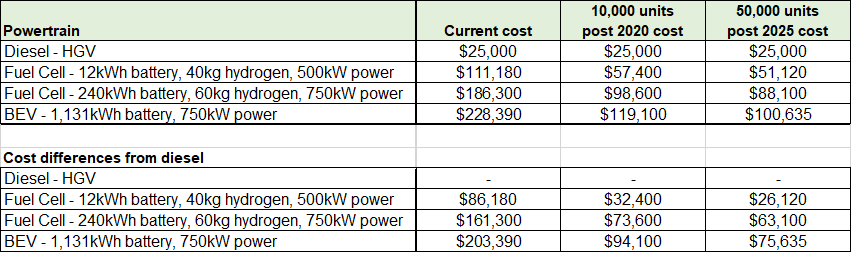

Estimated powertrain manufacturing costs are summarised in Figure 19. These are based on combining the fuel cell, hydrogen storage, traction drive and battery pack costs from Figures 14-18. Three manufacturing cost assumptions are presented:

- Current costs at 1,000 units/year

- Annual production of 10,000 units with technology advances anticipated by 2020

- Annual production of 50,000 units with technology advances anticipated by 2025

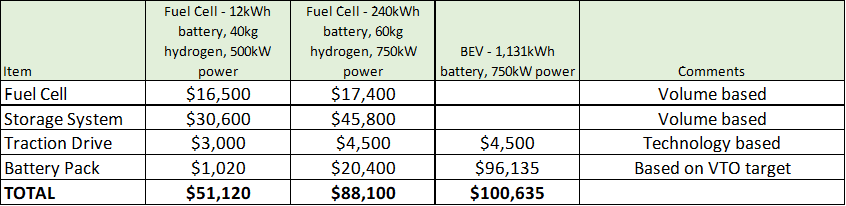

The author has estimated diesel powertrain manufacturing costs, excluding rear axle and suspension costs, at $25,000. Whilst Zhao (2013) gives an indicative manufacturing cost of a Class 8 truck diesel engine and fuel tank at circa $10,000, this excludes costs of the emission treatment system, transmission system and drive shaft. The power output of the BEV HGV is assumed to be 750kW, simply to select a specific electric traction drive system cost. Had 500kW output been chosen then this would reduce costs by circa $1,500-$4,500. Figure 20 below presents the key costs assuming annual production volume of 50,000 units per year and cost advances anticipated by 2025. What is shows are the key areas where costs will be a challenge even in 2025:

- Hydrogen storage

- Battery packs

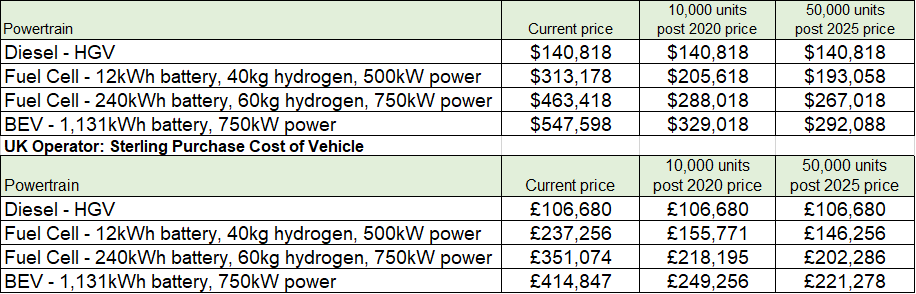

4.6 Estimated Purchase Price of HGV for UK Operator

UK indicative purchase prices have been calculated in Figure 21 by using a £106,680 ($140,818) base purchase price for a diesel-powered tractor unit (RHA 2018). Cost differences from diesel (Figure 19) have then been added with an author assumed 100% mark-up to cover truck supply chain overheads and profit. This estimated 100% mark-up is nominally based on a 67% manufacturer mark-up, followed by a 20% truck dealer mark-up. The figures are shown in US dollars and sterling with a conversion rate of $1.32/£. The purchase prices are indicative of the financial challenges faced by operators in making the switch to zero carbon in-use HGVs.

These purchase prices will be used in later parts to explore the financial challenges for operators.

Part 5 looks at the future costs of fuelling infrastructure and hydrogen production.

References

Bosch (2017). Press release: The “start-up” powertrain for electric cars: the Bosch e-axle offers greater range [online]. Available at https://www.bosch-presse.de/pressportal/de/en/the-start-up-powertrain-

for-electric-cars-the-bosch-e-axle-offers-greater-range-121216.html [Accessed 20 January 2020]

Bosch (2018). eAxle website page [online]. Available at https://www.bosch-mobilitysolutions.

com/en/products-and-services/passenger-cars-and-light-commercial-vehicles/powertrain-systems/

electric-drive/eaxle/ [Accessed 20 January 2020]

DOE (2015b). US Department of Energy Hydrogen and Fuel Cells Program Record [online]. Available at https://www.hydrogen.energy.gov/pdfs/15013_onboard_storage_performance_cost.pdf [Accessed 20 January 2020]

Reuters (2017) Press release: Bosch partners with startup Nikola on electric long-haul truck [online]. Available at https://www.reuters.com/article/us-autos-bosch/bosch-partners-with-startup-nikola-onelectric-

long-haul-truck-idUSKCN1BU1TO [Accessed 20 January 2020]

Reuters (2018) Press announcement: Toyota plans to expand production, shrink cost of hydrogen fuel cell vehicles [online]. Available at https://uk.reuters.com/article/uk-toyota-hydrogen/toyota-plansto-

expand-production-shrink-cost-of-hydrogen-fuel-cell-vehicles-idUKKBN1KH0Y5 [Accessed 20 January 2020]

RHA (2018). Our of our hands: Data on RHA’s Operator Costs For UK Trucks [ online]. Available at http://www.transportengineer.org.uk/article-images/166209/Out_of_our_hands.pdf [Accessed 20 January 2020]

PowerCell (2017). Press release: Nikola – A game changer for the automotive industry [online]. Available at https://www.powercell.se/en/newsroom/press-releases/detail/?releaseId=C59748A71D05DC4C [Accessed 20 January 2020]

SA (2016b). Strategic Analysis – Final Report: Hydrogen Storage System Cost Analysis [online]. Available at https://www.osti.gov/servlets/purl/1343975 [Accessed 20 January 2020]

SA (2017). Strategic Analysis – Mass Production Cost Estimation of Direct H2 PEM Fuel Cell Systems for Transportation Applications: 2017 Update [online]. Available at http://www.sainc.com/assets/site_18/files/publications/sa%202017%20transportation%20fuel%20cell%20cost%20analysis.pdf [Accessed 20 January 2020]

Trucks (2016). Truck website news article: Nikola One Hydrogen Fuel Cell Electric Semi-Truck Debuts [online]. Available at https://www.trucks.com/2016/12/01/nikola-one-hydrogen-fuel-cell–electric-semi-truck-debuts/ [Accessed 29 July 2018]

USDRIVE (2017a). Electrical and Electronics Technical Team Roadmap [online]. Available at https://www.energy.gov/sites/prod/files/2017/11/f39/EETT%20Roadmap%2010-27-17.pdf [Accessed 30 July 2018]

Zhao (2013). Analysis of Class 8 Hybrid-Electric Truck Technologies Using Diesel, LNG, Electricity, and Hydrogen, as the Fuel for Various Applications. 2013 World Electric Vehicle Symposium and Exhibition (EVS27), 11/2013

Leave a Reply